February might be the shortest month of the year, but that didn’t dampen the funding environment in the Boston startup land.

There were a handful of multimillion-dollar rounds: Jobcase, a platform dedicated to assisting people to find work, raised $100 million, biotechnology major Ginkgo Bioworks debuted its food ingredients startup Motif Ingredients that launched with $90 million in Series A. French-born Mirakl, a startup that provides technology to launch an e-commerce marketplace, raised $70 million.

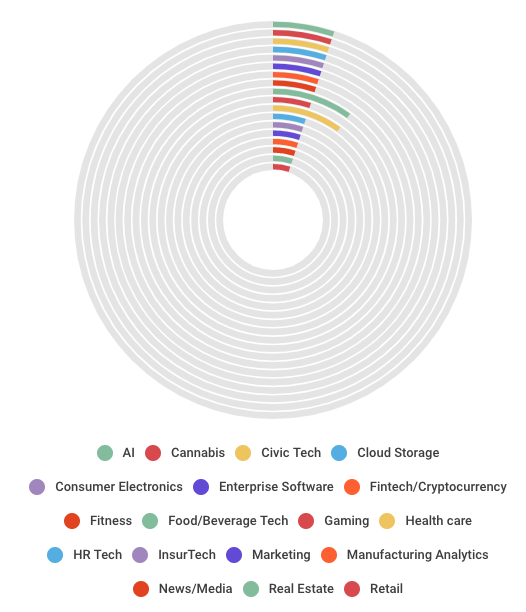

Image Courtesy: Infogram

FYI, we cover startup funding news in the BostInno Beat newsletter every weekday. Stay on top of who’s getting funded by signing up right here. See you in the inbox.

Below are the 21 startups that raised capital in February:

Artificial IntelligenceLightmatter, a Boston startup that makes light-powered AI chips, raised $22 million in Series A-1 funding led by Google Ventures. Existing investors Matrix Partners and Spark Capitalalso participated in the round.

CannabisAthol, Mass.-based Ascend Wellness, a company that cultivates and processes marijuana, raised $55 million in a new round of funding to support its rapid expansion in the east coast. The fund split comes with $37 million in a bridge round of preferred equity and $18 million in a senior note. The round was led by Shire Capital, Three Bays Capital, and JM10 Partners. Existing investors Poseidon Asset Management and Salveo Capital also participated.

Civic TechCambridge-based startup Polis raised $2.5 million in a seed funding round led by Haystack VC, a Menlo Park, Calif.-based VC and PE firm that invested in DoorDash and Instacart. The company, which was part of Techstars Boston spring cohort in 2016, is a provider of data and analytics software for both door-to-door political campaigns and commercial sales.

Cloud StorageNasuni, a provider of cloud storage and file sharing services based in the Seaport District, received $25 million in growth equity funding. The round was led by Telstra Ventures, the venture capital arm of Telstra, one of Australia’s largest telecommunications companies.

Read Complete Article